Tom Palmer, CEO of top global gold producer Newmont (NYSE: NGT; TSX: NEM), is monitoring three industry megatrends, which, if left unchecked, could simultaneously animate, interact with, and reinforce one another, giving rise to a growing industry meta-crisis.

These megatrends include society and investors, technological progress and geopolitical turbulence, all set to test his management skills.

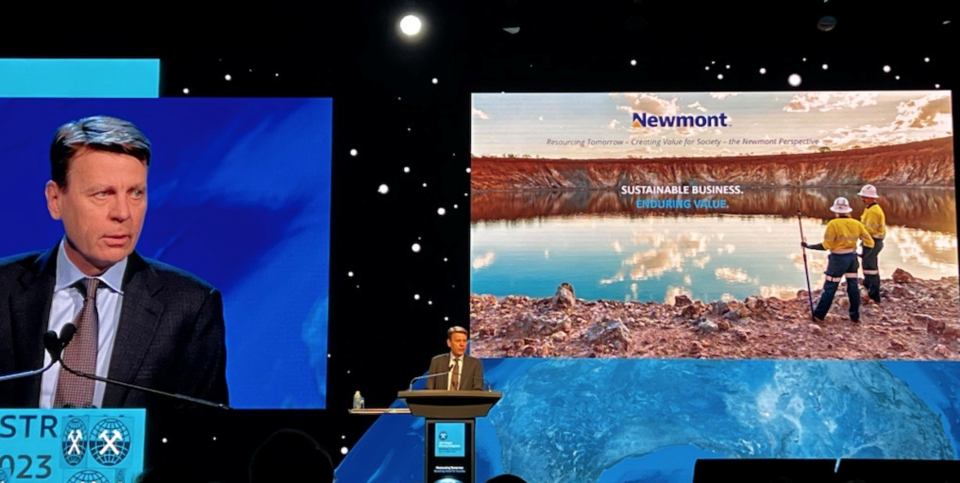

“The intensity and velocity of these global megatrends are so universal and disruptive that if, as an industry, we are not agile enough to adapt, align and lead, we will risk losing control of our businesses,” he told this week’s 26th World Mining Congress in Brisbane, Australia.

He underlined that these trends have already impacted the mining industry and will continue well into the future.

He suggests to successfully navigating this period of disruptive change will require knowing, integrating, and living each mining organization’s core values. “Failure to do so will leave us rudderless and at the mercy of these tidal waves of change in society, technology and geopolitics,” he said.

According to Palmer, there is an increasing demand for accountability and values-based decision-making on the societal front. “The mining industry must meet and exceed these demands to remain in business,” he said.

The CEO added that mining must satisfy society’s resource needs in the new energy future while ensuring safe and sustainable mining practices. Workforces are becoming more conscious of these expectations, and meeting them is critical for attracting and retaining talent.

On the technological front, the rapid acceleration of high-tech change, particularly in areas like artificial intelligence (AI) and language models, requires a balance between transformative technologies and human wisdom.

He acknowledged the need to address problems such as sexism, racism and harassment in the workplace to foster inclusive and safe environments that attract and retain the best talent.

“It is essential to make people-centric, values-based decisions to govern and harness these innovations responsibly,” Palmer said.

Automation, remote operations, and AI algorithms are being used in mining operations to improve safety, efficiency, and environmental impact. However, advancing technologies’ potential risks and unknown consequences must also be considered.

Geopolitical developments are driven by internal demographic changes, migration, political polarization, and economic anxiety that impact governments and international relations. These factors influence where mining companies explore, invest, and operate.

“It is crucial for mining companies to navigate geopolitical trends and engage with governments and stakeholders transparently and accountably. Values-based governance and accountability can help create stability and certainty in geopolitical environments,” Palmer said.

Most recently, Newmont sealed a deal to acquire Australia’s Newcrest Mining (TSX: NCM; ASX: NCM) after being separated for over 30 years. Newcrest accepted an A$26.2 billion ($17.5 billion) takeover offer on May 14. It has previously rejected two offers. The enterprise value of the offer is A$28.8 billion ($19.3 billion), including net debt.

The merger creates a mega-miner with the industry’s most extensive reserve and resource base. Newmont has mines in Australia, Africa and the Americas, with about 96 million oz. of gold reserves. Newcrest counts gold reserves of about 52 million ounces.

Newmont shares traded at C$55.42 apiece in Toronto at press time on Thursday, having dropped 31% in value over the past 12 months. Newmont has a market capitalization of $44 billion ($33.2bn).